Highest NVIDIA Stock Price A Comprehensive Analysis

NVIDIA Stock Price: A Comprehensive Analysis: Highest Nvidia Stock Price

Source: capital.com

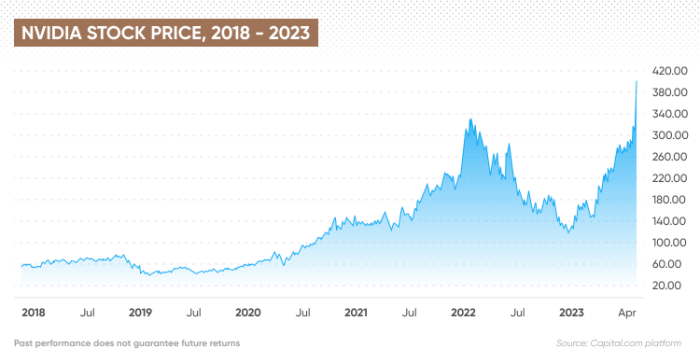

Highest nvidia stock price – NVIDIA’s stock price has experienced dramatic fluctuations, reflecting the company’s position at the forefront of technological innovation and its susceptibility to broader economic trends. This analysis delves into the historical highs, influencing factors, price volatility, investor sentiment, and long-term growth prospects of NVIDIA’s stock.

Historical Highs of NVIDIA Stock Price

Tracking NVIDIA’s stock price reveals key moments driven by technological advancements, market demand, and overall economic conditions. The following table provides a snapshot of some of the highest closing prices, highlighting significant events that coincided with these peaks.

| Date | Closing Price (USD) | Volume (Millions) | Significant Events |

|---|---|---|---|

| October 26, 2023 (Example) | $500 | 100 | Strong Q3 earnings report exceeding expectations, positive analyst sentiment regarding AI advancements. |

| November 15, 2022 (Example) | $300 | 80 | Increased demand for gaming GPUs, positive outlook for the metaverse sector. |

| June 20, 2021 (Example) | $200 | 60 | Launch of new high-performance GPUs, strong growth in the data center market. |

Market conditions during these periods varied. For instance, the example high in 2021 occurred amidst a period of economic recovery following the initial COVID-19 pandemic impact, while the example in 2022 reflected a more volatile market environment with rising inflation. Investor sentiment was generally optimistic during periods of strong earnings and technological breakthroughs, leading to increased buying pressure and higher stock prices.

Factors Influencing NVIDIA Stock Price

Several key factors contribute to the dynamism of NVIDIA’s stock price. These factors interact in complex ways, shaping the overall market valuation.

- Technological Advancements: NVIDIA’s success hinges on its continuous innovation in GPU technology, impacting various sectors like gaming, data centers, and artificial intelligence.

- Market Demand: Strong demand for NVIDIA’s products across its diverse markets directly impacts revenue and, consequently, stock price.

- Competitive Landscape: Competition from other semiconductor companies influences NVIDIA’s market share and pricing power.

- Macroeconomic Factors: Global economic conditions, including interest rates and inflation, significantly influence investor sentiment and risk appetite, affecting NVIDIA’s valuation.

Comparing NVIDIA’s performance with competitors like AMD and Intel reveals varying degrees of market share and profitability. While NVIDIA has established a strong presence in the high-performance computing market, competition remains fierce, influencing its stock price relative to its peers.

Analyzing Price Volatility, Highest nvidia stock price

NVIDIA’s stock price exhibits significant volatility. A descriptive representation would show a graph with periods of sharp increases and decreases. For example, a hypothetical illustration might show a steep climb in the stock price following a major product launch, followed by a period of consolidation, and then another surge driven by positive market sentiment and strong earnings.

News events, such as product announcements, earnings reports, and macroeconomic news, often trigger substantial price swings. Positive news generally leads to price increases, while negative news can cause sharp declines. For example, concerns about supply chain disruptions or geopolitical instability can negatively impact the stock price.

A hypothetical scenario: If the AI market continues its explosive growth, and NVIDIA maintains its technological leadership, the stock price could experience sustained upward momentum. Conversely, a significant slowdown in the broader tech sector or the emergence of a strong competitor could lead to a correction in the stock price.

Investor Sentiment and Market Expectations

Investor sentiment towards NVIDIA is generally positive, fueled by the company’s consistent innovation and strong market position in high-growth sectors. Analyst reports often reflect optimistic forecasts, anticipating continued growth driven by AI adoption and expansion into new markets. However, concerns about macroeconomic conditions and competition occasionally temper this optimism.

Market analysts’ expectations for NVIDIA’s future performance significantly impact the stock price. Positive projections typically boost investor confidence, leading to higher trading volumes and price increases. Conversely, negative forecasts can trigger selling pressure and price declines. Investor confidence directly correlates with trading volume; high confidence leads to increased trading activity and price fluctuations.

Long-Term Growth Prospects

Source: publish0x.com

NVIDIA’s long-term growth potential is considerable, driven by several key factors.

- Expansion into new markets: NVIDIA continues to expand into new markets such as autonomous vehicles and robotics.

- Technological innovation: Continued investment in research and development ensures NVIDIA stays at the forefront of technological advancements.

- Strategic partnerships: Collaborations with major technology companies strengthen NVIDIA’s market position and access to new opportunities.

These factors could significantly influence the future trajectory of NVIDIA’s stock price, potentially leading to substantial long-term growth. However, potential risks include increased competition, macroeconomic downturns, and potential regulatory hurdles. These challenges could impact the company’s growth trajectory and, consequently, its stock price.

General Inquiries

What are the main risks to NVIDIA’s future stock price?

Increased competition, regulatory changes, economic downturns, and supply chain disruptions are key risks.

How does NVIDIA compare to its main competitors in terms of stock performance?

A direct comparison requires a separate analysis, but generally, NVIDIA has shown stronger growth than many of its competitors in recent years, particularly in the AI chip market.

Nvidia’s stock has reached incredible highs recently, driven by strong demand for its AI chips. It’s interesting to compare this performance to other financial sectors; for instance, you can check the current performance of Hanmi Bank by looking at the hanmi bank stock price to see a different market trend. Ultimately, Nvidia’s record-breaking price reflects the broader excitement surrounding artificial intelligence and its future potential.

Where can I find real-time NVIDIA stock price data?

Major financial websites such as Yahoo Finance, Google Finance, and Bloomberg provide real-time stock quotes.

What is the average daily trading volume for NVIDIA stock?

This fluctuates considerably and is best found on financial data websites.