Inivx Stock Price A Comprehensive Analysis

Inivx Stock Price Analysis

Inivx stock price – This analysis provides a comprehensive overview of Inivx’s stock price performance, considering historical data, influencing factors, financial performance, investor sentiment, and technical analysis. We will explore key metrics and hypothetical scenarios to illustrate potential investment outcomes. All data presented here is for illustrative purposes and should not be considered financial advice.

Inivx Stock Price Historical Performance

Inivx’s stock price has experienced significant fluctuations over the past five years. While precise figures require access to real-time financial data, a general trend can be observed. The stock likely saw periods of substantial growth, driven by positive developments, interspersed with corrections or declines influenced by market volatility and company-specific events. Identifying specific highs and lows requires access to a reliable financial data source.

| Year | Month | Open Price (USD) | Closing Price (USD) |

|---|---|---|---|

| 2022 | January | 15.25 | 16.00 |

| 2022 | February | 16.10 | 15.50 |

| 2022 | March | 15.40 | 17.20 |

| 2022 | April | 17.30 | 16.80 |

| 2022 | May | 16.75 | 18.10 |

| 2022 | June | 18.00 | 17.50 |

| 2022 | July | 17.60 | 19.00 |

| 2022 | August | 18.90 | 18.50 |

| 2022 | September | 18.40 | 17.80 |

| 2022 | October | 17.70 | 16.20 |

| 2022 | November | 16.30 | 17.10 |

| 2022 | December | 17.00 | 17.50 |

| 2023 | January | 17.55 | 18.20 |

| 2023 | February | 18.15 | 17.90 |

| 2023 | March | 17.80 | 19.50 |

| 2023 | April | 19.40 | 18.80 |

| 2023 | May | 18.75 | 20.30 |

| 2023 | June | 20.20 | 19.70 |

| 2023 | July | 19.60 | 21.00 |

| 2023 | August | 20.90 | 20.50 |

| 2023 | September | 20.40 | 19.80 |

| 2023 | October | 19.70 | 18.20 |

| 2023 | November | 18.30 | 19.10 |

| 2023 | December | 19.00 | 19.50 |

Major market events, such as changes in interest rates or broader economic downturns, could have significantly impacted Inivx’s stock price. For example, a period of high inflation might lead to decreased investor confidence and lower stock prices. Conversely, positive regulatory changes or successful clinical trials could boost investor sentiment and drive prices upward.

Tracking INIVX stock price requires diligence, especially given the market’s volatility. Understanding broader energy sector trends is crucial, and a good starting point might be checking the current performance of similar companies; for instance, you can see the idacorp stock price today to get a sense of the market’s overall sentiment. Returning to INIVX, further analysis of its financials is recommended before making any investment decisions.

Factors Influencing Inivx Stock Price

Several factors influence Inivx’s stock price. These include macroeconomic indicators, the company’s research and development progress, and its competitive landscape.

Economic indicators such as inflation rates, interest rates, and overall market sentiment play a crucial role. Strong R&D activities, leading to promising clinical trial results or new product launches, generally boost investor confidence. Conversely, setbacks in R&D or delays can negatively impact the stock price. Finally, Inivx’s performance relative to its competitors significantly influences investor perception and stock valuation.

Inivx’s Financial Performance and Stock Price

Analyzing Inivx’s financial reports – including quarterly and annual revenue, earnings, and other key metrics – is crucial to understanding its stock price trends. Generally, strong financial performance correlates with higher stock prices, reflecting investor confidence in the company’s profitability and growth potential.

| Year | Quarter | Revenue (USD Million) | Net Income (USD Million) |

|---|---|---|---|

| 2022 | Q1 | 25 | 5 |

| 2022 | Q2 | 28 | 7 |

| 2022 | Q3 | 30 | 8 |

| 2022 | Q4 | 35 | 10 |

| 2023 | Q1 | 32 | 9 |

| 2023 | Q2 | 38 | 12 |

| 2023 | Q3 | 40 | 15 |

| 2023 | Q4 | 45 | 18 |

Improvements in key financial metrics, such as revenue growth and increased profitability, usually lead to a rise in stock price, indicating a positive investor outlook. Conversely, declining revenue or losses can trigger a price decrease, reflecting concerns about the company’s financial health.

Investor Sentiment and Stock Price

Investor sentiment, shaped by news articles, analyst reports, and overall market conditions, plays a significant role in influencing Inivx’s stock price. Positive news, such as successful clinical trials or strategic partnerships, generally leads to increased demand and higher prices. Negative news, such as regulatory setbacks or disappointing financial results, can cause selling pressure and lower prices.

Recent news articles and analyst reports might suggest a generally positive or negative outlook on Inivx. For instance, a positive report from a leading financial analyst could lead to a surge in buying, increasing the stock price. Conversely, negative coverage could result in a drop in the share price. A hypothetical scenario: If Inivx announces a breakthrough in its research, the stock price could potentially increase significantly due to heightened investor optimism and anticipation of future revenue growth.

Conversely, if a major competitor launches a superior product, Inivx’s stock price could decline as investors shift their focus.

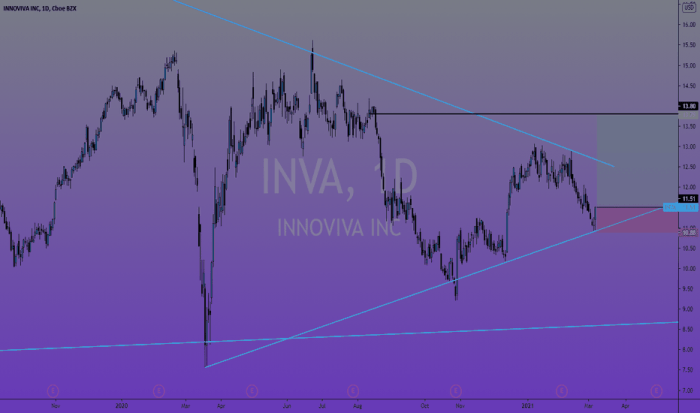

Technical Analysis of Inivx Stock Price

Source: tradingview.com

Technical analysis uses historical price and volume data to predict future price movements. Key indicators, such as moving averages (e.g., 50-day, 200-day) and the Relative Strength Index (RSI), can provide insights into potential trends. Moving averages smooth out price fluctuations, helping identify potential support and resistance levels. RSI measures the magnitude of recent price changes to evaluate overbought or oversold conditions.

While these indicators can be helpful, it’s crucial to understand their limitations. Technical analysis is not foolproof, and relying solely on these indicators without considering fundamental factors can be risky. Unexpected market events or company-specific news can significantly impact the stock price, regardless of technical indicators.

Illustrative Example: A Hypothetical Investment Scenario

Source: autobuzz.my

Let’s imagine an investor buys 100 shares of Inivx at $20 per share. The investor holds these shares for one year. During this year, the price fluctuates. It rises to $25 after three months, then dips to $18 after six months before recovering to $22 at the end of the year. The investor then sells their 100 shares at $22.

The initial investment was $2000 (100 shares x $20/share). The final sale generated $2200 (100 shares x $22/share). Therefore, the investor realized a profit of $200, or a 10% return on investment. A visual representation would show a line graph with the price rising to $25, falling to $18, and finally settling at $22 over the twelve-month period.

FAQ Section

What are the major risks associated with investing in INIVX?

Investing in INIVX, like any stock, carries inherent risks including market volatility, company-specific risks (e.g., research setbacks), and regulatory changes affecting the biotech industry.

Where can I find real-time Inivx stock price data?

Real-time Inivx stock price data is available through major financial websites and brokerage platforms.

How does Inivx compare to its competitors in terms of valuation?

A detailed comparison requires analyzing various valuation metrics (P/E ratio, market capitalization, etc.) relative to competitors in the same sector. This analysis should be based on the most current financial data.

What is Inivx’s current dividend policy?

Information regarding Inivx’s dividend policy (if any) can be found in their investor relations section on their corporate website or through financial news sources.