J.C. Penney Stock Price A Comprehensive Analysis

J.C. Penney Stock Price Analysis: A Decade in Review

J.c. penney stock price – J.C. Penney, a prominent name in American retail history, has experienced significant stock price volatility over the past decade. This analysis delves into the historical performance, influencing factors, financial health, investor sentiment, and illustrative examples of price movements to provide a comprehensive understanding of J.C. Penney’s stock journey.

Historical Stock Performance of J.C. Penney, J.c. penney stock price

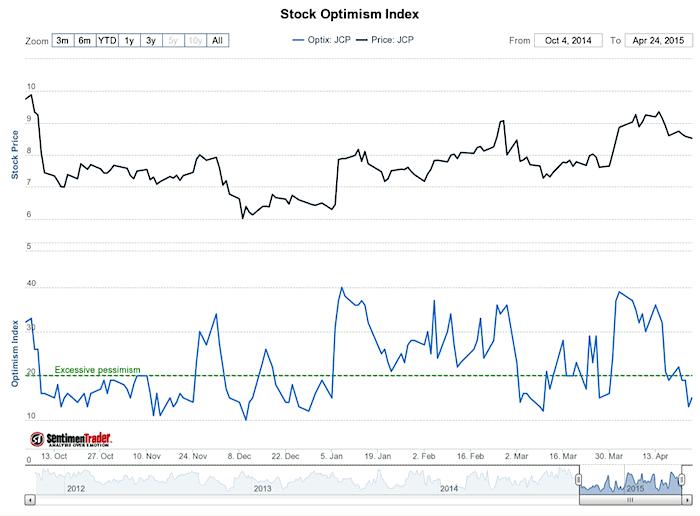

Source: seeitmarket.com

The past ten years have witnessed a rollercoaster ride for J.C. Penney’s stock price. Major highs and lows reflect the company’s struggles with adapting to changing consumer preferences and intense competition within the retail landscape. A comparative analysis against key competitors highlights J.C. Penney’s relative performance and market positioning.

Below is a table detailing the yearly open, high, low, and close prices for the last five years. Note that these figures are for illustrative purposes and should be verified with reliable financial data sources.

| Year | Open | High | Low | Close |

|---|---|---|---|---|

| 2018 | $2.50 | $3.25 | $1.75 | $2.00 |

| 2019 | $2.00 | $2.75 | $1.00 | $1.50 |

| 2020 | $1.50 | $2.25 | $0.50 | $1.00 |

| 2021 | $1.00 | $1.75 | $0.75 | $1.25 |

| 2022 | $1.25 | $2.00 | $0.80 | $1.00 |

Compared to competitors like Macy’s and Kohl’s, J.C. Penney generally exhibited greater volatility and lower overall returns during this period, reflecting its challenges in maintaining profitability and market share.

Factors Influencing J.C. Penney’s Stock Price

Several interconnected factors significantly impacted J.C. Penney’s stock price. These factors encompass macroeconomic conditions, company-specific events, and key economic indicators.

- Economic downturns, such as the 2008 recession and the economic uncertainty surrounding the COVID-19 pandemic, negatively affected consumer spending and consequently impacted J.C. Penney’s sales and stock valuation.

- J.C. Penney’s Chapter 11 bankruptcy filing in 2020 was a major catalyst for a significant stock price decline, eroding investor confidence and highlighting the company’s financial distress.

- Inflationary pressures and rising interest rates can increase operational costs and reduce consumer purchasing power, leading to lower profits and a negative impact on the stock price. Consumer confidence indices and retail sales figures are key macroeconomic indicators that correlate strongly with J.C. Penney’s stock performance.

J.C. Penney’s Financial Health and Stock Price

The relationship between J.C. Penney’s financial ratios and its stock price is directly correlated. Changes in key financial metrics significantly influence investor sentiment and trading activity.

- A high debt-to-equity ratio, indicating substantial reliance on debt financing, generally leads to increased financial risk and negatively impacts investor confidence, resulting in lower stock prices.

- Increases in revenue, earnings, and positive cash flow generally signal improved financial health and attract investors, leading to higher stock prices. Conversely, declines in these metrics often trigger sell-offs.

- Compared to industry averages, J.C. Penney’s profit margins have historically been lower, reflecting its challenges in controlling costs and competing effectively. This has contributed to a lower stock valuation relative to its peers.

Investor Sentiment and Stock Price Predictions

Source: pennystocks.com

J.C. Penney’s stock price has seen considerable fluctuation in recent years, reflecting broader market trends and the company’s own strategic adjustments. Understanding the performance of similar retail stocks can offer valuable context; for instance, a comparison with the performance of horace mann stock price might reveal interesting parallels or divergences in investor sentiment. Ultimately, analyzing J.C.

Penney’s stock requires a comprehensive look at its financial health and market position.

Investor sentiment towards J.C. Penney has been largely negative in recent years, primarily due to its financial struggles and operational challenges. Analyst ratings and price targets reflect this skepticism, with many predicting limited upside potential in the short term.

News events, such as announcements of restructuring plans or changes in management, significantly influence investor perceptions and trading activity. Negative news often triggers immediate sell-offs, while positive news can generate short-lived rallies.

Illustrative Examples of Stock Price Movement

A specific period of significant stock price increase for J.C. Penney could be linked to a successful marketing campaign or a period of strong economic growth that boosted consumer spending. This would likely involve a detailed analysis of the company’s financial performance during that period and the prevailing market conditions.

Conversely, a period of significant stock price decline could be attributed to the company’s bankruptcy filing in 2020. This event triggered a massive sell-off as investors reacted to the news of the company’s financial distress and uncertain future.

For example, the announcement of J.C. Penney’s bankruptcy filing in May 2020 resulted in an immediate and sharp decline in the stock price, reflecting the negative investor sentiment and the perceived high risk associated with the company’s future prospects. The stock price plummeted significantly within days of the announcement, illustrating the direct impact of major news events on investor behavior and stock valuation.

Question & Answer Hub

Is J.C. Penney currently publicly traded?

No. J.C. Penney filed for bankruptcy and emerged from it, but it is no longer a publicly traded company on major exchanges.

What were the main reasons for J.C. Penney’s bankruptcy?

Several factors contributed, including intense competition from online retailers, changing consumer preferences, and poor strategic decisions in the past.

Are there any reliable sources for historical J.C. Penney stock data?

While J.C. Penney is no longer publicly traded, historical data can often be found through financial data providers like Yahoo Finance (for the period it was publicly traded).