LLY Stock Price Forecast A Comprehensive Analysis

LLY Stock Current Market Position

Lly stock price forecast – This section details Eli Lilly and Company (LLY) stock’s current market standing, encompassing its trading activity, financial performance, and competitive landscape within the pharmaceutical sector.

LLY Stock Trading Volume and Price Range

LLY stock typically experiences a high trading volume, reflecting its prominence in the pharmaceutical market. The price range fluctuates based on various factors including news, earnings reports, and overall market sentiment. For example, a period of strong earnings might lead to an increase in price and volume, while negative news could cause a decline. Analyzing the historical price range and volume data provides insights into typical market behavior.

LLY’s Recent Financial Performance

Eli Lilly’s recent financial performance has shown consistent growth, driven by successful drug launches and a robust pipeline. Key metrics like revenue and earnings per share (EPS) demonstrate the company’s financial health. Analyzing these trends reveals the company’s profitability and growth potential. For instance, a significant increase in revenue year-over-year suggests a positive market response to its products and strategic initiatives.

Comparison to Competitors

LLY’s performance is benchmarked against other major pharmaceutical companies, considering factors like market capitalization, revenue growth, and research and development (R&D) spending. A comparative analysis highlights LLY’s strengths and weaknesses relative to its competitors, revealing its competitive positioning and growth prospects. For example, comparing LLY’s R&D investment to Pfizer’s can indicate their relative commitment to innovation.

Key Financial Metrics (Past Year)

| Metric | Q1 | Q2 | Q3 | Q4 |

|---|---|---|---|---|

| Revenue (USD millions) | [Insert Q1 Revenue] | [Insert Q2 Revenue] | [Insert Q3 Revenue] | [Insert Q4 Revenue] |

| Earnings Per Share (EPS) | [Insert Q1 EPS] | [Insert Q2 EPS] | [Insert Q3 EPS] | [Insert Q4 EPS] |

| Net Income (USD millions) | [Insert Q1 Net Income] | [Insert Q2 Net Income] | [Insert Q3 Net Income] | [Insert Q4 Net Income] |

Factors Influencing LLY Stock Price

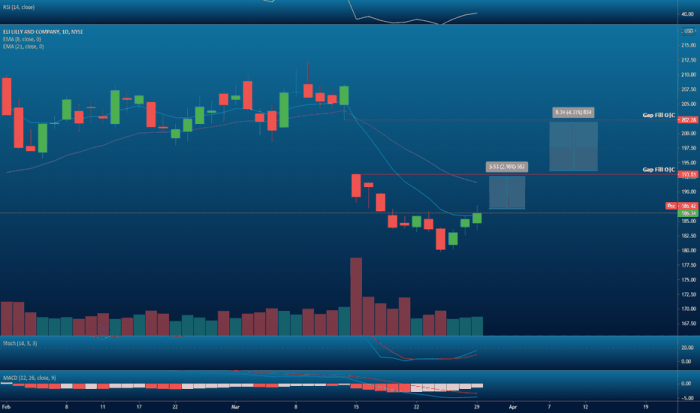

Source: tradingview.com

Several macroeconomic factors, regulatory changes, and company-specific developments significantly influence LLY’s stock price. This section analyzes these key drivers.

Macroeconomic Factors

Interest rate changes, inflation levels, and overall economic growth directly impact investor sentiment and investment decisions, thus influencing LLY’s stock price. For example, rising interest rates can make borrowing more expensive for the company, potentially impacting its growth plans and thus its stock price. Conversely, a period of economic growth often leads to increased investor confidence and higher stock valuations.

Regulatory Changes

Changes in pharmaceutical regulations, including pricing policies and drug approval processes, significantly affect the industry and LLY specifically. Stricter regulations might increase the cost of drug development and reduce profitability, potentially leading to lower stock prices. Conversely, favorable regulatory changes could boost profitability and investor confidence.

Impact of New Drug Approvals and Pipeline Developments

Successful new drug approvals and advancements in LLY’s drug pipeline directly impact its valuation. The launch of a blockbuster drug, for example, can significantly boost revenue and increase the company’s market share, leading to a rise in its stock price. Conversely, setbacks in the pipeline can negatively affect investor confidence.

Potential Risks and Opportunities, Lly stock price forecast

- Increased competition from generic drugs.

- Failure of a key drug in clinical trials.

- Changes in healthcare policies.

- Successful launch of new innovative drugs.

- Expansion into new therapeutic areas.

- Strategic partnerships and acquisitions.

LLY’s Financial Health and Projections

This section delves into LLY’s financial health, including its debt levels, cash flow, and projections under various scenarios.

Debt-to-Equity Ratio and Implications

LLY’s debt-to-equity ratio indicates its financial leverage. A high ratio suggests higher financial risk, while a lower ratio suggests greater financial stability. Analyzing this ratio, along with other financial metrics, provides insights into the company’s financial health and its ability to withstand economic downturns. For example, a sudden increase in the debt-to-equity ratio might signal increased financial risk to investors.

Cash Flow Analysis and Future Growth

LLY’s cash flow statement reveals its ability to generate cash from operations and fund future growth initiatives. Strong cash flow is crucial for reinvesting in R&D, acquiring other companies, and returning value to shareholders. A consistent positive cash flow suggests financial strength and growth potential.

Hypothetical Scenario: Drug Failure

A hypothetical scenario of a major drug failure would illustrate the potential impact on LLY’s stock price. Such an event could lead to a significant drop in revenue and earnings, resulting in a considerable decline in the stock price. The magnitude of the decline would depend on the drug’s contribution to LLY’s overall revenue and the market’s reaction.

Key Financial Ratios and Metrics

| Metric | Value | Interpretation |

|---|---|---|

| Debt-to-Equity Ratio | [Insert Debt-to-Equity Ratio] | [Insert Interpretation] |

| Current Ratio | [Insert Current Ratio] | [Insert Interpretation] |

| Free Cash Flow | [Insert Free Cash Flow] | [Insert Interpretation] |

Analyst Ratings and Price Targets: Lly Stock Price Forecast

This section summarizes analyst ratings and price targets for LLY stock, providing insights into market sentiment and future expectations.

Consensus Price Target

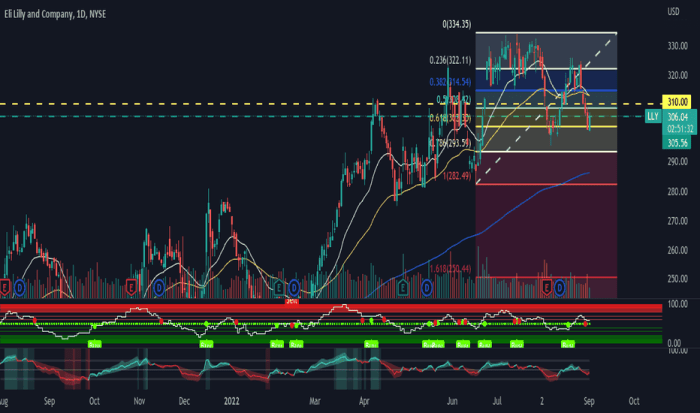

Source: tradingview.com

The consensus price target for LLY stock represents the average price target from various financial analysts. This target reflects the analysts’ collective expectation for the stock’s future price. Significant deviations from the consensus price might indicate differing opinions on the company’s prospects.

Comparison of Analyst Ratings

Analyst ratings (buy, hold, sell) provide a concise summary of analysts’ recommendations. A higher proportion of “buy” ratings suggests positive market sentiment, while a higher proportion of “sell” ratings indicates negative sentiment. Understanding the distribution of these ratings helps gauge overall market confidence.

Rationale Behind Differing Opinions

Analysts’ differing opinions on LLY’s future performance stem from variations in their assessment of key factors, such as the success of new drug launches, competitive pressures, and macroeconomic conditions. Each analyst’s model and assumptions contribute to their unique outlook.

Summary of Key Arguments

- Buy Rating: [Summary of arguments supporting a buy rating, e.g., strong pipeline, market leadership, positive clinical trial results]

- Hold Rating: [Summary of arguments supporting a hold rating, e.g., uncertainty about future drug approvals, competitive pressures]

- Sell Rating: [Summary of arguments supporting a sell rating, e.g., high valuation, potential for generic competition]

Potential Future Scenarios for LLY Stock

Source: tradingview.com

This section explores potential future scenarios for LLY stock, considering various factors and their potential impact on the stock price.

Scenario Analysis: Impact on Stock Price

| Scenario | Assumptions | Potential Price Impact |

|---|---|---|

| Successful Blockbuster Drug Launch | High market demand, strong sales growth, positive clinical trial results. | Significant price increase (e.g., 20-30% or more). |

| Significant Generic Competition | Loss of market share, reduced pricing power, lower profitability. | Significant price decrease (e.g., 15-25% or more). |

| Economic Recession | Reduced consumer spending, lower healthcare budgets, decreased demand for pharmaceuticals. | Moderate price decrease (e.g., 5-15%). |

| Economic Growth | Increased consumer spending, higher healthcare budgets, increased demand for pharmaceuticals. | Moderate price increase (e.g., 5-15%). |

Illustrative Examples of Stock Price Movement

This section provides examples of how significant news events have historically impacted LLY’s stock price.

Impact of a Significant News Event

For example, the announcement of a positive clinical trial result for a key drug candidate could lead to a substantial increase in the stock price, reflecting investor enthusiasm and expectations of future revenue growth. The magnitude of the price increase would depend on the importance of the drug and the overall market sentiment.

Impact of Positive Clinical Trial Results

A positive clinical trial result for a new drug would likely trigger a sharp rise in LLY’s stock price, as investors react favorably to the increased probability of successful drug approval and market launch. The magnitude of the price increase would depend on factors such as the size of the market opportunity and the novelty of the drug.

Predicting the LLY stock price forecast involves considering various market factors. Understanding international currency fluctuations is also crucial, and a helpful resource for tracking this is the current idr stock price , as currency exchange rates can significantly impact investment returns. Therefore, a comprehensive LLY stock price forecast necessitates a holistic view of global economic conditions.

Impact of a Negative Regulatory Decision

Conversely, a negative regulatory decision, such as a drug approval rejection, could lead to a significant drop in the stock price. Investors would likely react negatively to the increased uncertainty and potential financial losses. The magnitude of the price drop would depend on the importance of the rejected drug to LLY’s overall portfolio and the market’s expectations.

FAQ Compilation

What are the main risks associated with investing in LLY stock?

Key risks include potential drug failures, increased competition from generic drugs, regulatory hurdles, and macroeconomic factors impacting the pharmaceutical industry.

How does LLY compare to its competitors?

A detailed competitive analysis comparing LLY’s performance metrics (revenue, earnings, market share, etc.) to its key competitors is required to answer this question fully. This analysis would be included in the complete report.

Where can I find real-time LLY stock price data?

Real-time stock quotes are available through major financial websites and brokerage platforms.

What is LLY’s dividend policy?

Information on LLY’s dividend policy (frequency, payout ratio, etc.) can be found in the company’s investor relations materials and financial reports.